Back

January 18, 2023

About Arch

Arch is a next-generation financial technology company that allows alternative asset owners access to debt to maximize their financial potential. Today, Arch welcomes crypto as collateral and offers individuals loans that traditional lending services do not, granting them the ability to access capital to make other investments or other large purchases while continuing to participate in the upside of their assets. With an instant approval process, secure, qualified custody,US-based regulatory first approach, and competitive rates, Arch makes obtaining a loan against alternative assets seamless. You may be wondering, why would I borrow against crypto and other digital assets? We’ll touch more on this below.

Crypto and digital asset returns

Crypto and digital assets have appreciated greatly over the last couple of years. As an example, from 2010-2021, BTC had an average annual return of ~115%. You may also believe that we are still in the early innings of crypto adoption and are poised to see further growth in assets such as BTC, ETH and other blue-chip cryptocurrencies. As a result, you’d like to hold onto these investments to continue to capture future upside.

Why get a loan?

Life happens, and perhaps you need cash to make other investments, handle expenses or make a large purchase. Often times, individuals sell their assets in order to make other investments or make larger purchases. Selling assets, not only is tax inefficient as it triggers a tax liability, by locking in capital gains**, but also deprives the individual from benefiting from the future appreciation of the asset**, as they no longer own it. However, this is where borrowing against your assets can be used as an advantage. You can use a loan to:

Access leverage to buy additional crypto

Make other investments

Make large one-off purchases

Pay for large one-off expenses, such as a tax bill

For everyday cashflow purposes

Generally

Leveraging existing assets is an approach widely used across assets like stocks (margin lending) and real estate (home equity lines of credit). Unfortunately, the traditional financial system disadvantages crypto holders as they do not accept these assets as collateral. This is a gap that Arch fills. Please note, however, that borrowing against crypto assets is not completely risk-free.

Risks for borrowing against crypto & digital assets

One main risk when borrowing against crypto & digital assets is the risk of liquidation. Liquidation occurs when the value of your collateral decreases and starts to approach the value of your outstanding loan balance. In these events, Arch will notify you across channels and ask you to deposit additional collateral, pay down some of the loan, or some combination of the two. This is a very similar mechanism to margin loans on stocks. How is this tracked? See below.

Loan-to-Value (LTV) is a calculation used to assess the risk of a loan. LTV is calculated as the loan amount in USD divided by the value of the collateral in USD, expressed as a percentage.

A loan with a higher LTV is generally seen as higher risk and a loan with a lower LTV as lower risk. The level of risk is directly tied to the likelihood that the collateral will need to be liquidated.

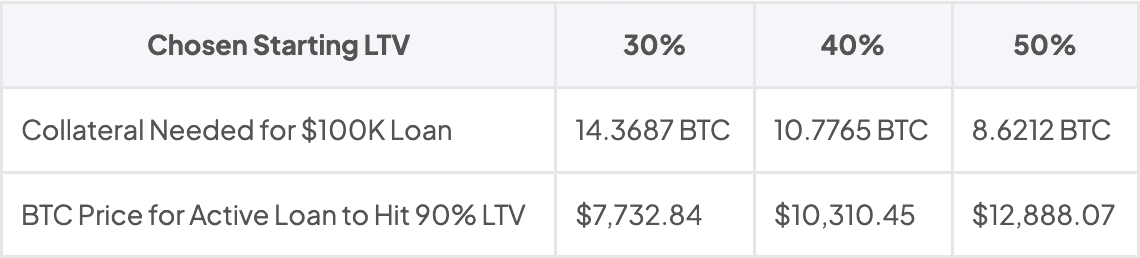

Here is an example of a loan to show how much an example collateral price has to drop to get liquidated once the LTV reaches 90%. At Arch, customers can configure their starting LTV to be lower (thus safer) than the maximum allowed, as shown below.

Loan Amount: $100,000.00

Collateral type: Bitcoin

Collateral Price: $23,198.52

The risk of liquidation is a key risk associated with borrowing against your crypto assets. That being said, there are three ways to mitigate this risk.

Add additional collateral to your loan when the value decreases. Arch will send you notifications with ample time for you to act and add collateral as your LTV starts to decrease.

Pay down a portion of your loan amount early.The second way to mitigate the liquidation risk is to pay down a portion of your loan amount early. Note that liquidation is only in the event that the value of your assets decreases. If the value increases, you can qualify for an additional loan amount.

Select a lower LTV (Loan to Value) ratio at the beginning of the loan. The third way is to decrease the LTV (Loan to Value) ratio at beginning the loan. To circle back to the example above, you could also decide to only take a $25,000.00 loan against the $200,000.00 of BTC collateral. This would give you a wider margin of safety in the event that the BTC price decreases. Arch has a maximum LTV per asset but you as the borrower are welcome to decrease the LTV as you prefer.